Corporate Finance

Corporate finance encompasses the crucial aspects and the steps that management takes to increase the value of a company. It is considered a liaison between the capital market and the institution, focusing on capital formation and corporate development.

Corporate Finance in India

Corporate finance encompasses the crucial aspects and the steps that management takes to increase the value of a company. It is considered a liaison between the capital market and the institution. Thus, it deals with the capital formation and development of the corporation. In practical terms, Corporate finance includes the company’s decisions about its financial results, tools, and analysis used to prioritize and allocate financial resources. So, corporate financing ultimately aims to increase the value of the business by planning & implementing resources and balancing risk & profitability.

Advantages of Corporate Finance

Global Exposure to Opportunities

Gain access to global opportunities that maximize your business potential.High Potential for Growth

Unlock opportunities for rapid and sustainable growth in your business.Access to Capital

Enhance your access to a variety of funding options to support business needs.Improved Efficiency

Boost productivity by leveraging streamlined financial strategies.Risk Reduction

Reduce uncertainties and ensure a stable financial foundation.Enhanced Profitability

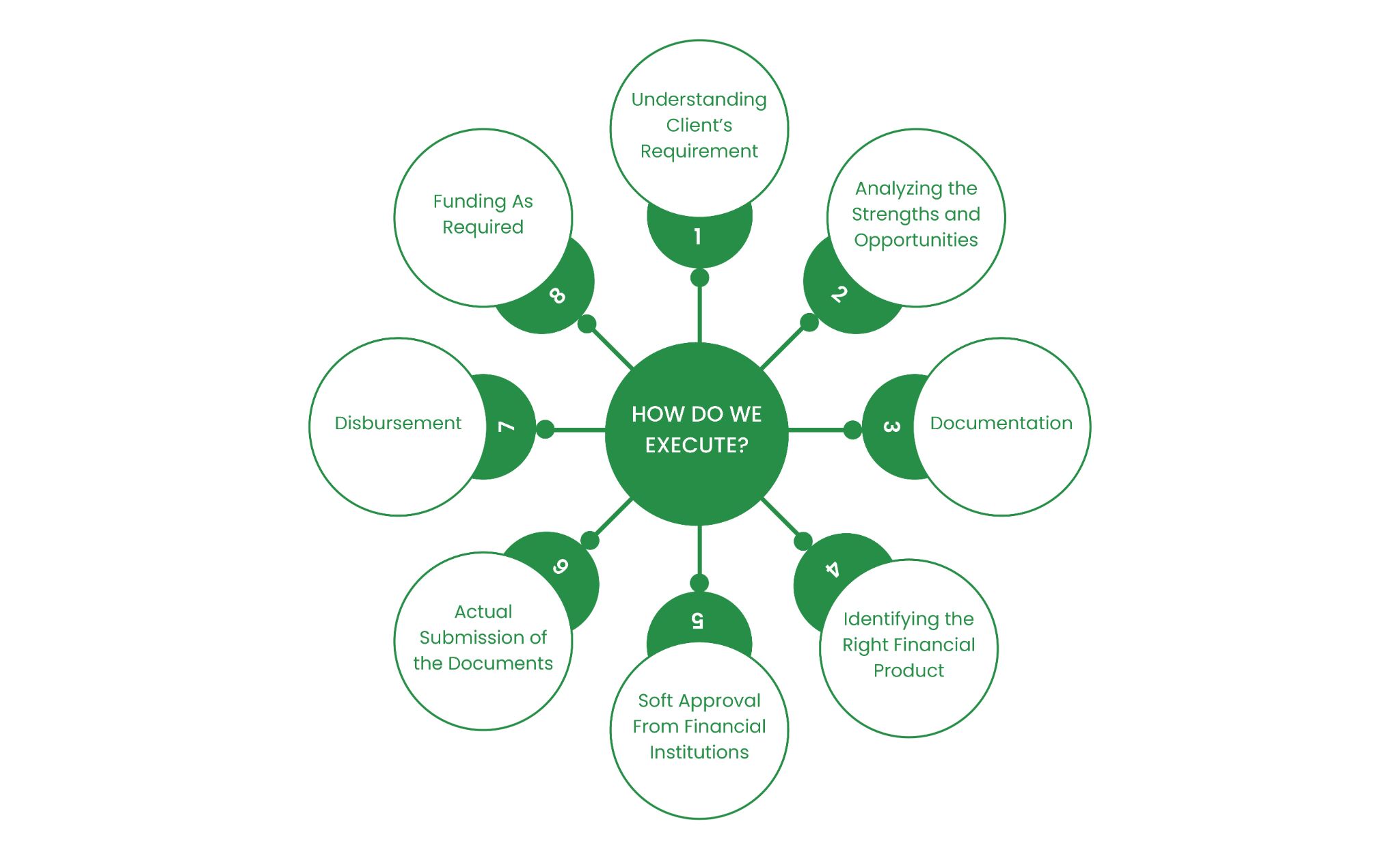

Achieve consistent and enhanced profitability through optimized financial decisions.Here’s the Execution Process to Avail Corporate Finance

Working Capital Finance

In the normal course of operations, a business must have the cash to pay expenses and liabilities that are due. This may include Trade payables, Payroll, Monthly Rent and Utility Expenses and other Operating Costs. Working capital is the money that is available to cover these expenses and is readily accessible. Purpose: Investment in current assets mainly stock & book debts- Cash Credit Limit

- Overdraft Limit

- Letter of Credit

- Bill Discounting

- Factoring

Project/Expansion Finance

Investment in fixed assets is essential for business growth. Instruments to finance working capital include:- Term Loan

- Letter of Credit

- External Commercial Borrowing (ECB)

- Buyers Credit

- Deferred Payment Guaranteed